We Beat the Market. You Can Too.

Businesses that are part of the Open Performance Fund have saved millions of pounds on energy.

OPF, what is it?

The Open Performance Fund is a solution to beating the market in both a rising and falling market. The fund saves our customers millions of pounds every year and removes the stress and hassle of dealing with energy markets and price fluctuations. The secret ingredient to success is taking a longer-term buying strategy executed by an industry-leading team of energy traders.

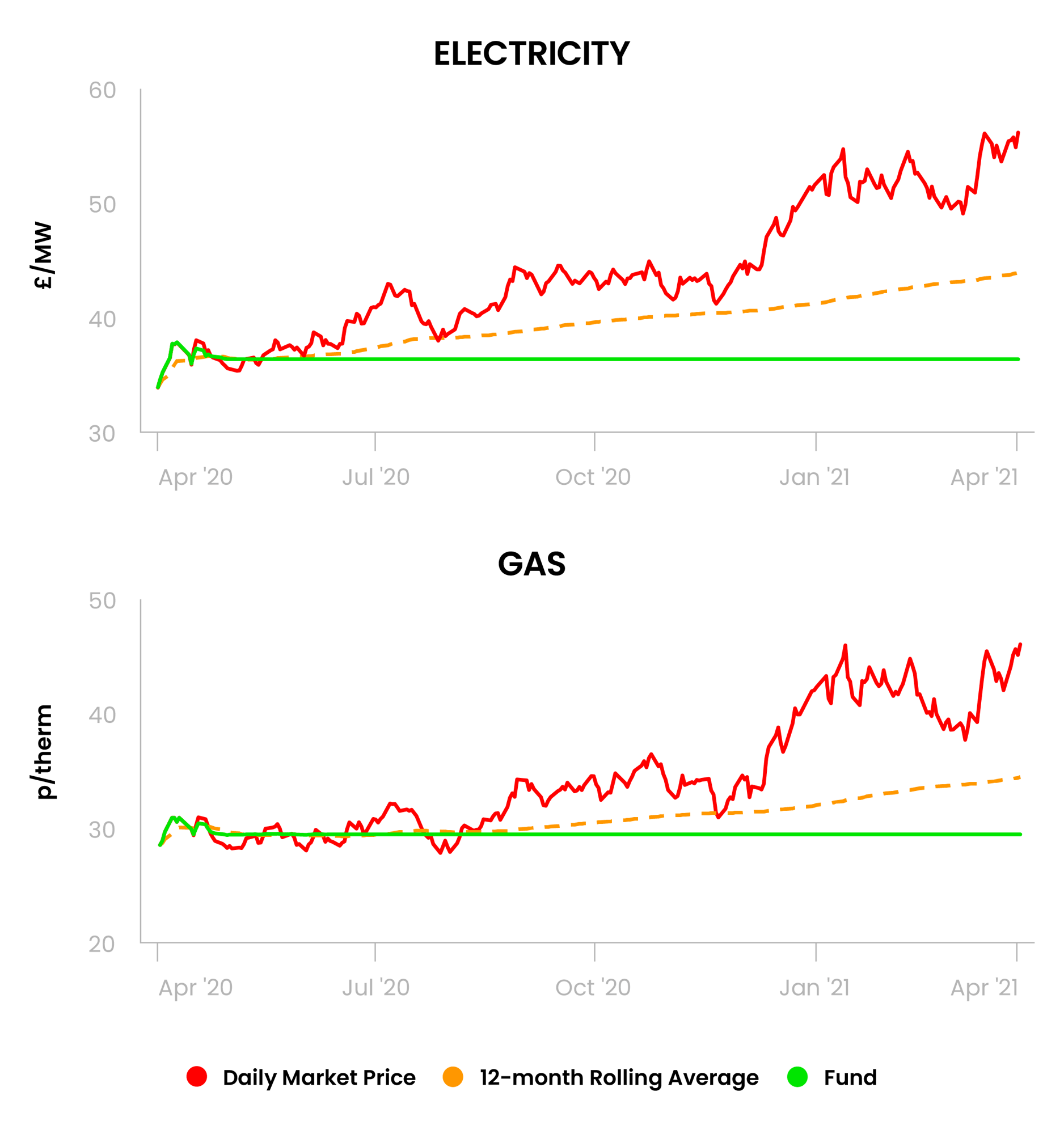

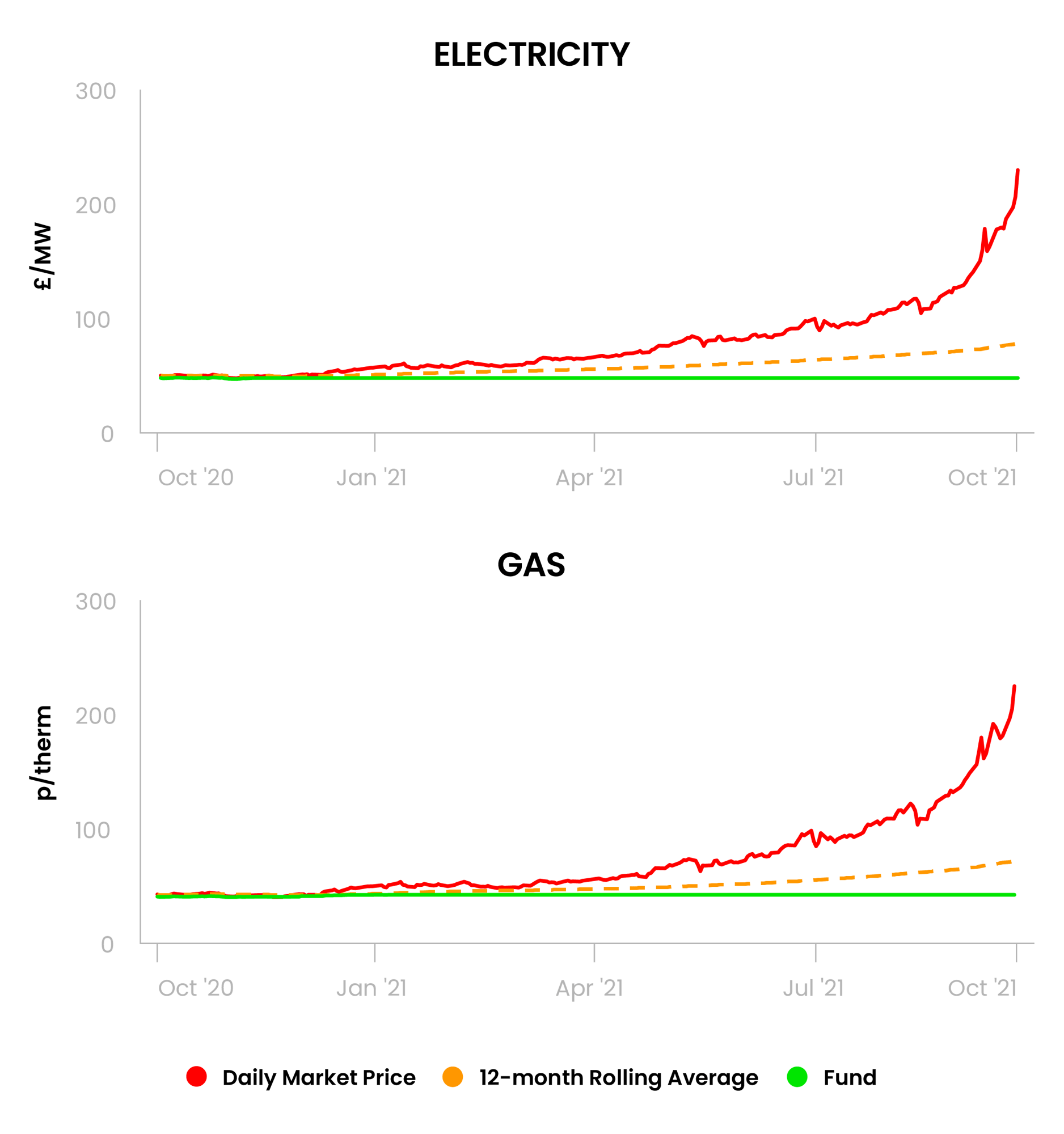

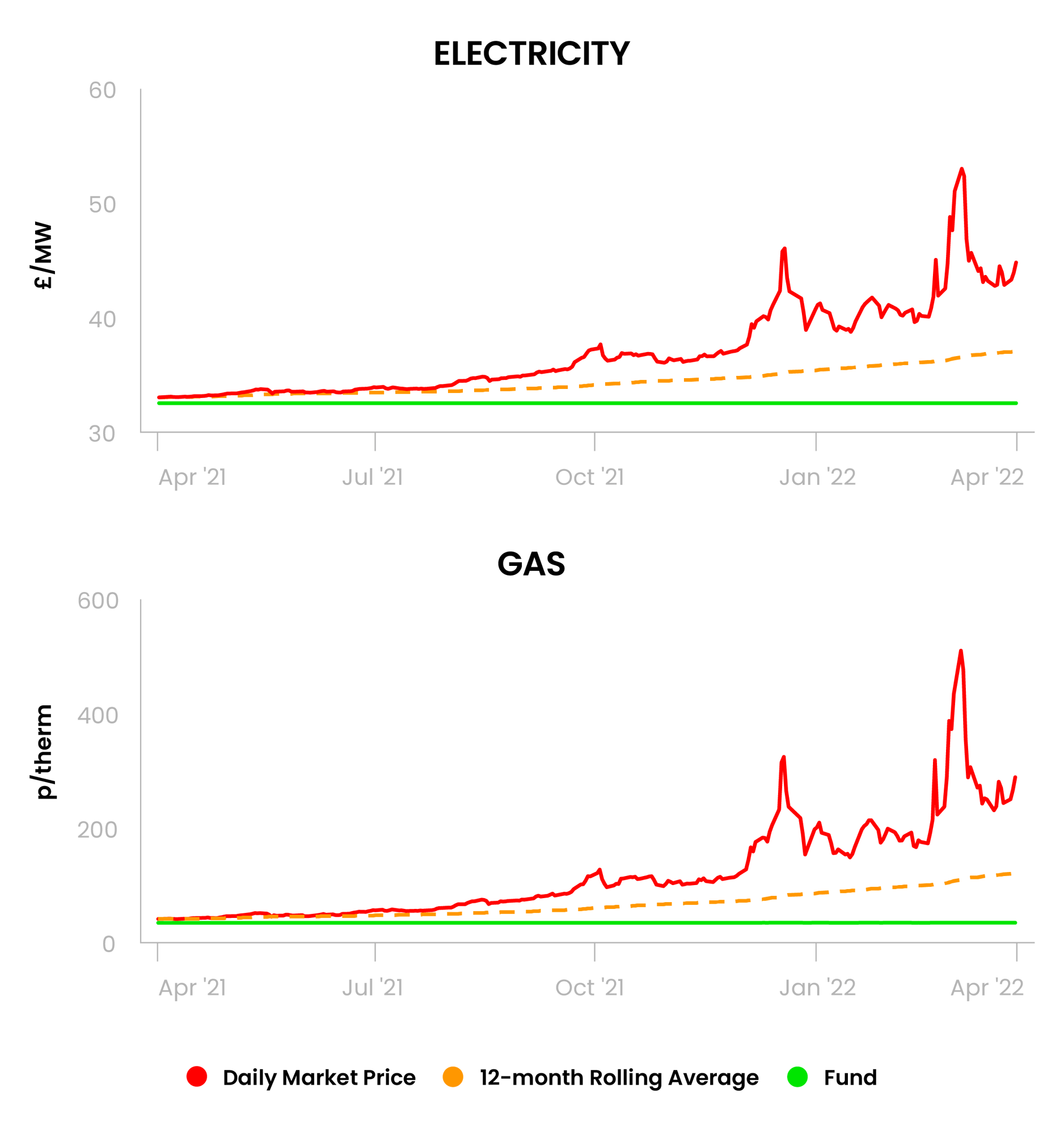

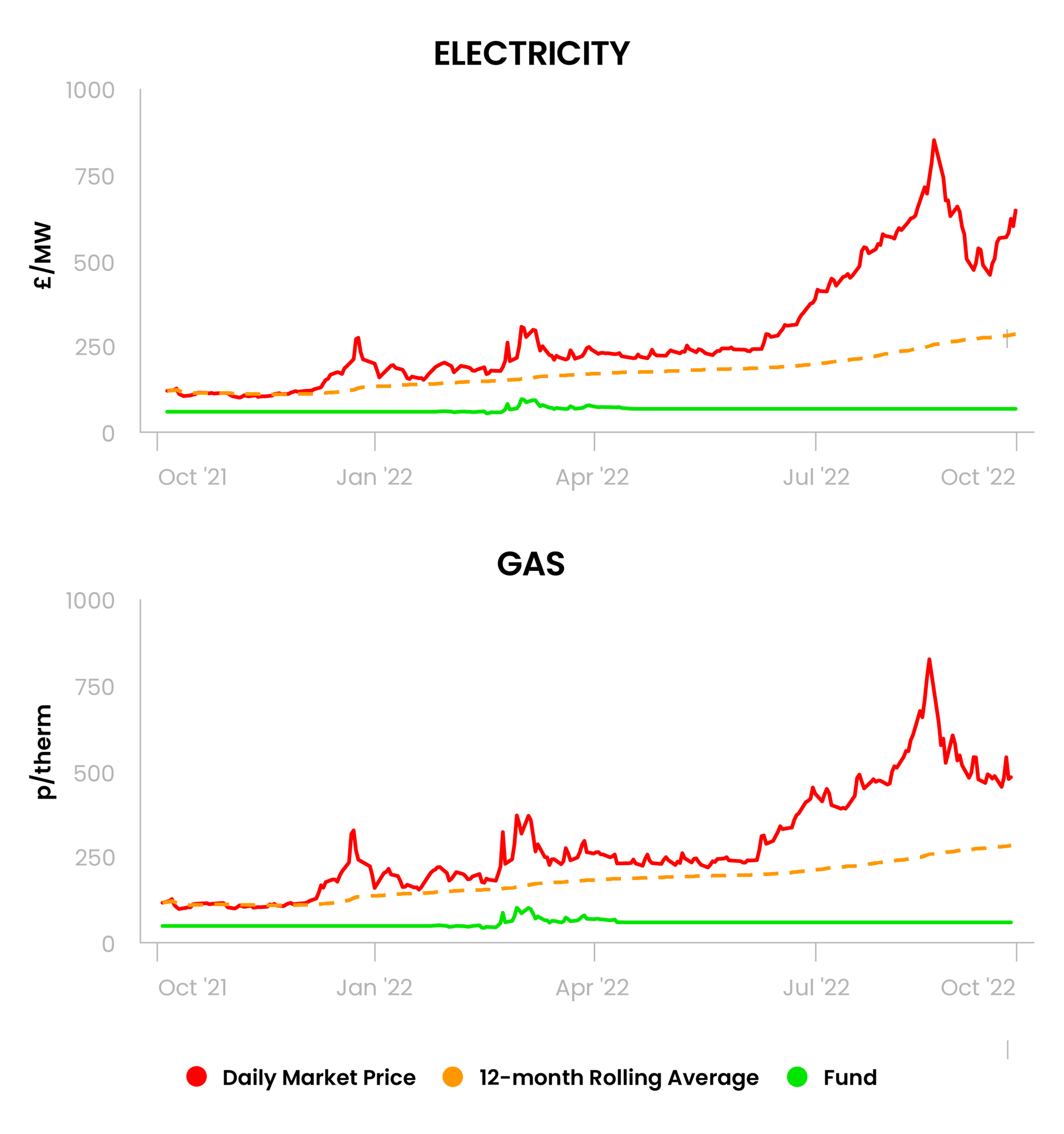

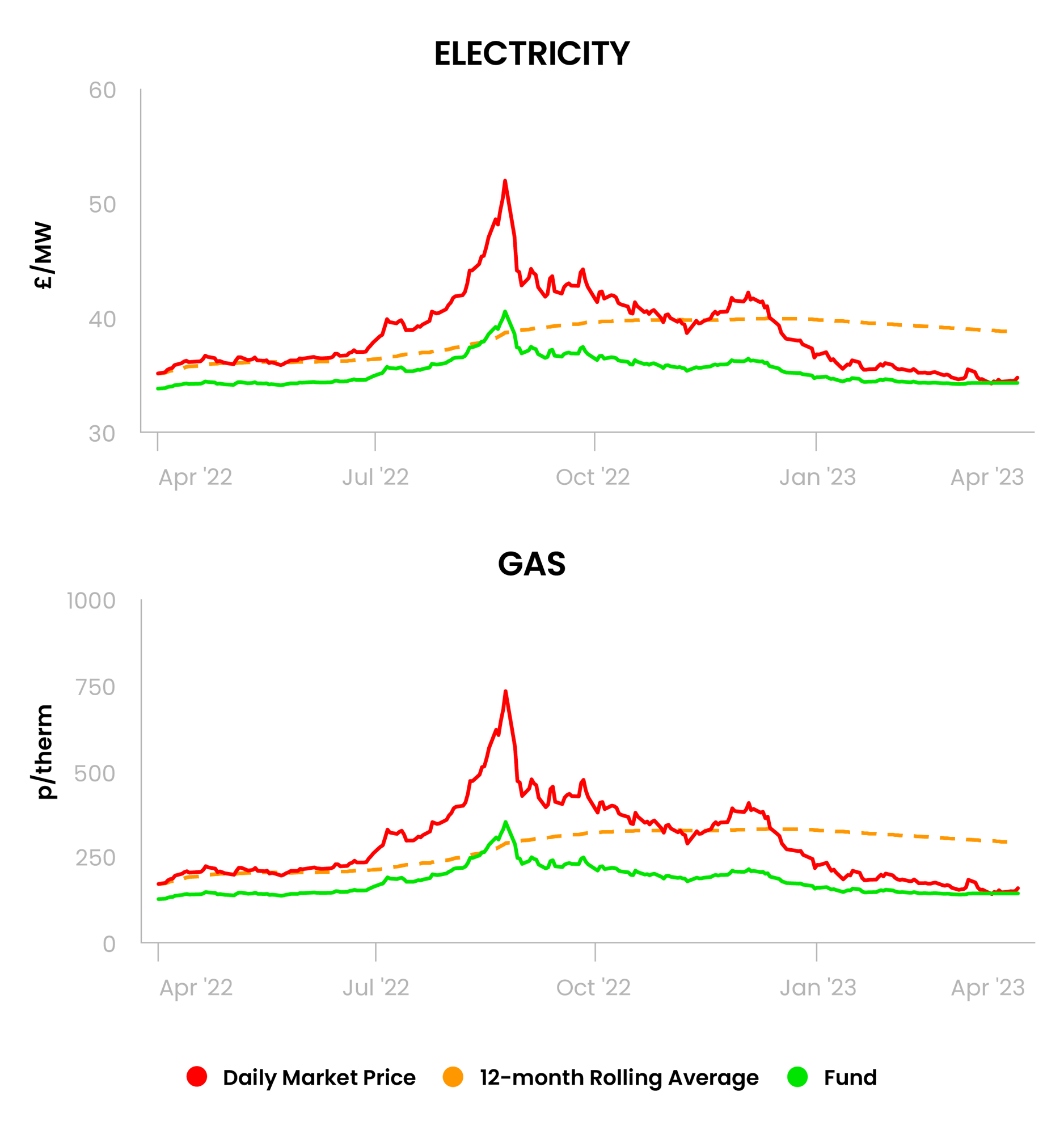

Consistently Outperforming the Market

Season after season the Open Performance Fund trading team have significantly outperformed the 12-month rolling market average across both Gas and Power.

The Proof is in Our Performance

“We’ve been supported with excellent advice and support through some very turbulent times. The fund has saved us material sums as we have been able to fix utility supplies at below the market rate. This has given the business sufficient stability to be able to think beyond volatility in the market for the long term."

Jonathan Neame, CEO, Shepherd Neame

Actual Customer Portfolio Performance

The chart below shows how an actual customer portfolio has fared against the market. You can see how they have been protected from the worst of the rising market and have maintained a significant advantage even in the falling market. Being part of the fund allows customers to have the flexibility to hedge against future seasons while at the same time being protected against the risk energy volatility in the present.

UK POWER: SUMMER 24

Contract Signature 16/07/2021