3 min read

UK Energy Market Analysis - February & March

![]() True Powered by Open Energy Market

:

Feb 19, 2024 1:43:58 PM

True Powered by Open Energy Market

:

Feb 19, 2024 1:43:58 PM

Turning the clocks back to August 2022, when gas and power prices spiked to all-time record highs of around £800/MWh and 800p/therm respectively, if someone were to predict that prices would be ceding their way back towards pre-Ukraine invasion levels 18 months later, they would be met with almost complete disbelief.

This comes despite the ongoing geo-political risk from the Ukraine invasion, but also with added tension in the Middle East, with threats of escalation potentially impacting deliveries of Liquid Natural Gas (LNG) through the Red Sea.

The obvious question then, is why have prices fallen so heavily over the last 18 months and can we expect this trend to continue?

The most prevalent driver of the hugely bearish sentiment we have seen over this period can be broadly categorised into three deciding factors:

Weather, increased LNG deliveries and record-high gas storage levels.

Going into last winter, there were legitimate concerns that the UK may run out of gas as a result of the (almost) complete Russian gas cut into European markets.

Thankfully, the weather conditions were kind in the UK and the country managed to come out of the winter in greater health than expected. Combined with significantly increased deliveries of LNG from the US and Asian markets and significant injections of gas into storage throughout the course of last summer, the UK entered winter 23/24 with storage levels at almost complete capacity.

The trend of milder (and windier) winters has continued and – so far – this winter has followed a similar pattern to last year, with the net result leaving our storage levels at record highs for this time of year (currently 66.2% full).

As a result, near-term market prices have plummeted and the risk premium built into forward prices have followed suit: Summer-24 gas is currently trading around 63p/therm and the power contract around £59/MWh, while the Winter-24 contract has shown similar downward pressure with prices trading around 77p/therm for gas and £72.50/MWh for power.

(CLICK HERE TO SEE HOW OUR OPEN PERFORMANCE FUND PERFORMED AGAINST THE MARKET)

With this significant reduction in prices, many buyers of energy contracts are now looking at significant reductions in price (particularly those who have bought contracts over the last 18 months) and those with a particular risk profile may want to consider locking in some of this value either through a fixed price contract or by increasing their cover in flexible contracts.

However, it is important to note that the short-term outlook remains healthy from an energy price perspective. The economic environment remains very fragile, with official confirmation coming this week that the UK fell into a recession in the final quarter of 2023 due to poor performance in the manufacturing, construction and wholesale sectors.

The situation was slightly healthier on the continent, with the eurozone unexpectedly avoiding recession during this same period, as strong growth in Spain and Italy offset the downturn in Germany.

Taken as a whole, this is expected to lead to stable demand over the coming months, and barring major interruptions in flows from the Middle East, supply is expected to remain healthy.

Short-term factors also suggest a continuation of the current bearish trend: warmer-than-average temperatures for North-Western Europe are expected to continue over the coming weeks and falling coal and carbon prices (both at eight and thirty-month lows respectively) adding to the overall bearish sentiment.

Unfortunately, the energy market is rarely straightforward, and with the ongoing geo-political risk detailed above, prices remain fragile and in a state of asymmetric risk meaning prices could rise much further than they could fall.

It’s a vital time for energy buyers to assess their energy strategy.

Current prices will offer a significant discount for many buyers which is encouraging news for UK businesses and the uncertainty will mean that flexible and fund contracts remain an attractive proposition for buyers looking for a more nuanced strategy that can both protect against rising prices and offer participation in falling markets, if the bearish trend continues.

WORK WITH OUR TEAM OF EXPERTS TO ACCESS REDUCED ENERGY PRICES

The Open Performance Fund saves our customers millions of pounds every year while removing the stress and hassle of dealing with the energy markets, as everything is managed by market analysts and traders.

(the guys who wrote the deep-dive above...)

The secret ingredient to success is taking a longer-term buying strategy.

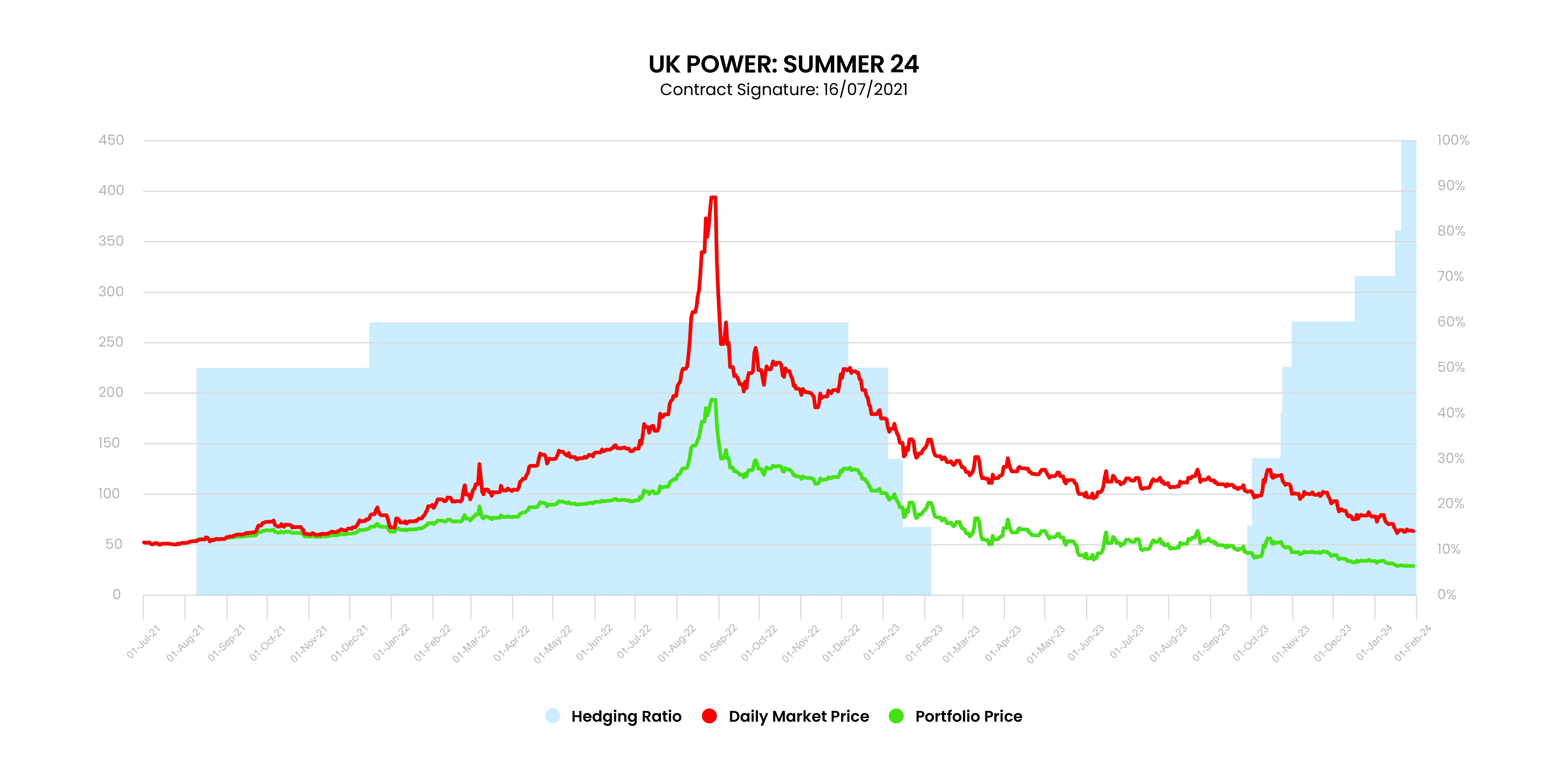

The graph below illustrates how one of our customers has benefited from the Open Performance Fund for Power for the summer 24 seasons.

The green line shows their portfolio price in relation to the market price (red) and the blue blocks show the hedging ratios.

To access these prices, get in touch with our team and join the fund, today.